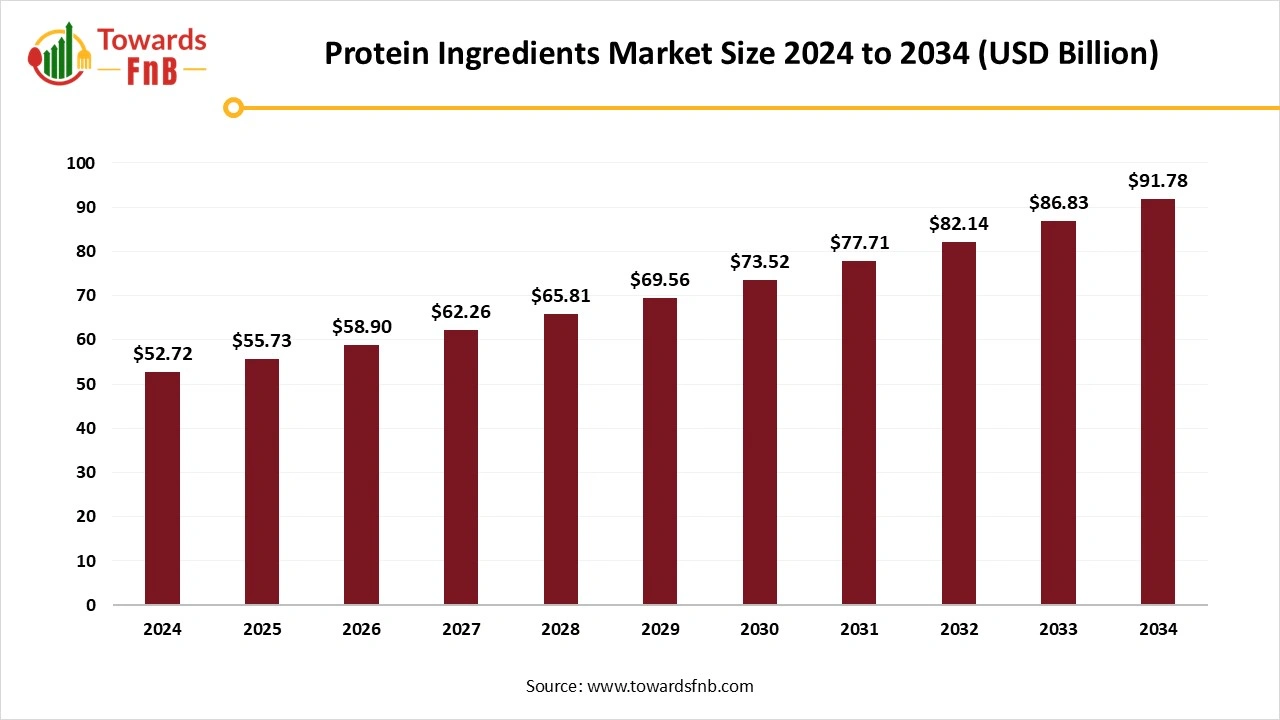

Protein Ingredients Market Size to Exceed USD 91.78 Billion by 2034 | Towards FnB

According to Towards FnB, the global protein ingredients market size is evaluated at USD 55.73 billion in 2025 and is anticipated to surge USD 91.78 billion by 2034, reflecting at a CAGR of 8.8% from 2025 to 2034. The surge in market value is largely driven by the increasing demand for protein-rich foods and ingredients across various sectors, including food, beverages, and nutraceuticals.

Ottawa, Dec. 01, 2025 (GLOBE NEWSWIRE) -- The global protein ingredients market size stood at USD 52.72 billion in 2024 and is predicted to increase from USD 55.73 billion in 2025 to reach around USD 91.78 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is observed to grow due to higher demand for protein-rich food options. Such options help enhance muscle recovery, aid weight loss, and support people working out in the gym.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5929

Key Highlights of the Protein Ingredients Market

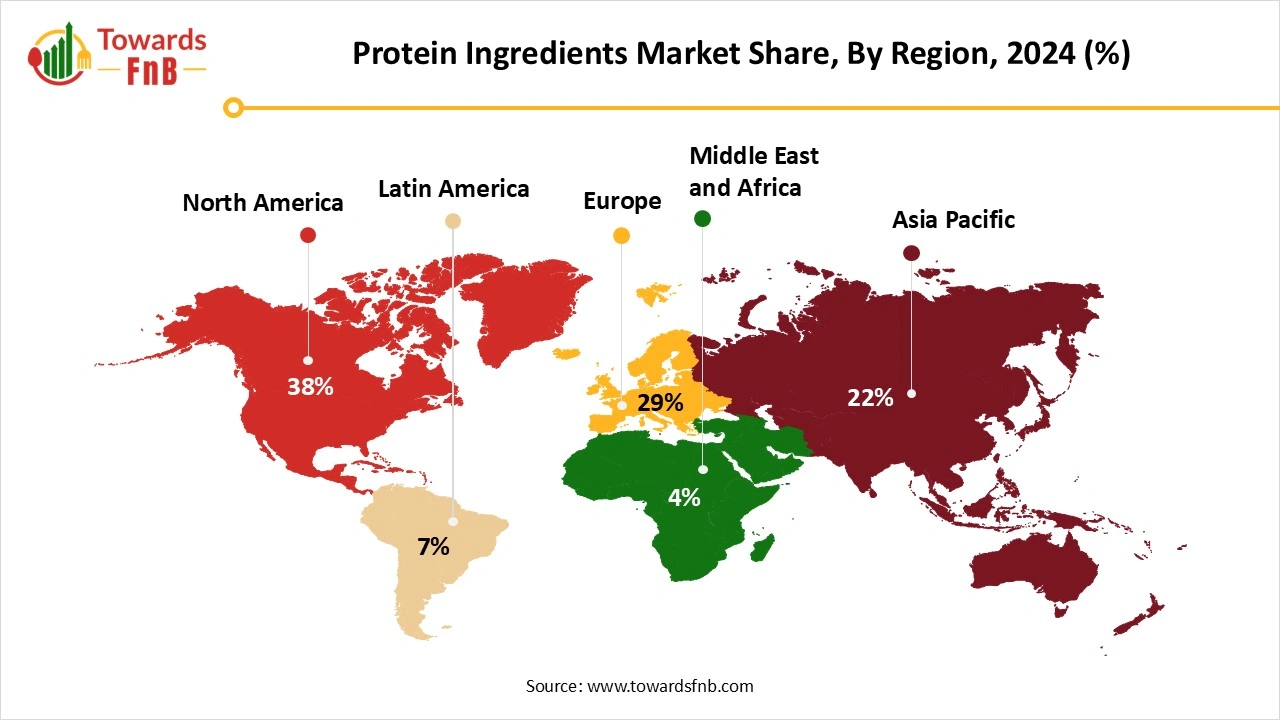

- By region, North America led the protein ingredients market with highest share of 38% in 2024, whereas the Asia Pacific is expected to grow in the forecast period.

- By product, the animal/dairy protein ingredients segment led the protein ingredients market in 2024, whereas the insect protein segment is expected to grow in the foreseeable period.

- By application, the food and beverage segment dominated the protein ingredients market in 2024, whereas the animal feed segment is projected to grow in the foreseeable period.

Higher Demand for Protein Variants Is Helpful for the Protein Ingredients Sector Growth

The protein ingredients market is expected to grow due to rising demand for both animal and plant-based protein products. Such food options offer multiple benefits, including being essential for gym rats and muscle recovery, as well as being helpful for consumers on a weight-loss spree. Higher demand for functional food, vegan and vegetarian options, and nutraceuticals is also a major driver of the growth of the protein ingredients industry.

The growing population of health-conscious consumers has recently led to higher demand for vegan and plant-based options, which is also helping propel market growth. Hence, such consumers highly demand plant-based food, beverages, and protein sources. They are low in fat and have lower cholesterol levels. Hence, they provide various benefits for bodily functions, further fueling the industry’s growth.

Technological Advancements Are Helpful for the Market’s Growth

Technological advancements that enhance the formula and benefits of the product are among the major factors driving the growth of the protein ingredients market. Technological advancements help improve fermentation precision, non-thermal processing, enzymatic modification, and advanced extraction methods. Such methods help to improve the functionality, purity, and sustainability of protein. Technological advancements, such as AI and ML, help identify consumer demands and make product modifications accordingly. Hence, such factors help to fuel the market’s growth in the foreseen period. Various other improved methods, such as microencapsulation and 3D printing, enhance protein stability, texture, and delivery, further fueling market growth. Such advancements enhance cost-effectiveness, which is helpful for mass production.

Recent Developments in the Protein Ingredients Market

- In November 2025, Tetra Pak launched its sunflower protein, a plant-based protein to help the food and beverage industry expand its product category. The new protein consists of 50% protein along with fiber, vitamins, and antioxidants.

- In August 2025, Burcon NutraScience announced the successful commercial production and launch of FavaPro, its 90%+ high-purity fava protein isolate.

Impact of AI in the Protein Ingredients Market

Artificial intelligence (AI) is reshaping the protein ingredients market by accelerating formulation development, improving production efficiency, and enhancing consumer alignment across both plant and animal-based protein categories. In research and formulation, AI-powered algorithms analyze large datasets on amino acid profiles, functional properties, and consumer dietary trends to identify optimal protein combinations for specific applications such as sports nutrition, bakery, dairy alternatives, and ready-to-drink beverages. Machine learning models simulate how different proteins, such as whey, casein, soy, pea, rice, and insect-based proteins, behave under various processing conditions, reducing trial-and-error and enabling manufacturers to achieve ideal solubility, texture, and flavor.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/protein-ingredients-market

New Trends of Protein Ingredients Market

- Higher demand for plant-based protein options by health-conscious consumers is one of the major factors for the growth of the market.

- Higher consumer awareness of sustainability and eco-friendly protein sources is another major factor driving market growth.

- Higher demand for a variety of protein sources in different forms, such as sports drinks and protein supplements, is another major factor for the market’s growth.

- Product innovation helps manufacturers introduce protein in new ways and across different products, thereby driving market growth.

- Improving technology is helpful to enhance the taste, texture, and nutritional quality of various protein sources, and also helps propel the growth of the market.

Product Survey of the Protein Ingredients Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or End Use Segments | Representative Producers or Brands |

| Whey Protein Ingredients | Dairy-derived proteins with high biological value and strong solubility. | Whey protein concentrate, whey protein isolate, hydrolyzed whey protein | Sports nutrition, RTD shakes, bakery, infant formula | Arla Foods Ingredients, Hilmar, Glanbia Nutritionals |

| Casein and Caseinates | Slow-digesting proteins are used for functional properties and nutritional value. | Micellar casein, calcium caseinate, sodium caseinate | Sports nutrition, cheese, bakery, and medical nutrition | Fonterra, FrieslandCampina Ingredients |

| Egg Protein Ingredients | High-quality complete proteins derived from egg whites and whole eggs. | Egg white powder, egg protein isolate | Sports nutrition, bakery, confectionery | Kewpie, Rose Acre Farms |

| Soy Protein Ingredients | Affordable plant proteins with strong functional capabilities. | Soy protein isolate, soy protein concentrate, textured soy protein | Meat alternatives, bakery, sports nutrition | ADM, Cargill, DuPont Nutrition |

| Pea Protein Ingredients | Plant-based proteins with clean label appeal and good digestibility. | Pea protein isolate, textured pea protein, pea flour | Dairy alternatives, meat alternatives, nutrition products | Roquette, Puris, Ingredion |

| Rice Protein Ingredients | Hypoallergenic plant proteins are used for blends and clean-label products. | Rice protein concentrate, rice protein isolate | Infant foods, vegan nutrition, smoothies | Axiom Foods, RiceBran Technologies |

| Wheat Protein Ingredients | Functional proteins provide elasticity and structure. | Vital wheat gluten, hydrolyzed wheat protein | Bakery, plant-based meats, noodles | Manildra Group, Roquette |

| Collagen and Gelatin Proteins | Animal-derived proteins are used for beauty, joint health, and functional gelling. | Type I and II collagen, gelatin powder | Beauty supplements, gummies, capsules | Gelita, Nitta Gelatin |

| Animal-Based Protein Powders | Non-dairy animal proteins for high-protein products. | Beef protein isolate, chicken protein powder | Sports nutrition, specialty diets | MuscleMeds, BHN, Essentia Protein Solutions |

| Algae and Microbial Protein Ingredients | Sustainable next-generation proteins produced through microalgae or fermentation. | Spirulina protein, chlorella, fermentation-derived protein | Functional foods, beverages, and alternative proteins | Corbion, Triton Algae Innovations |

| Hemp Protein Ingredients | Plant proteins rich in fiber and omega fatty acids. | Hemp protein powder, cold-pressed hemp protein | Vegan nutrition, smoothies, snacks | Manitoba Harvest, Nutiva |

| Fava Bean and Lupin Protein Ingredients | Emerging plant proteins with strong functional profiles. | Fava protein concentrate, lupin protein isolate | Dairy alternatives, bakery, meat alternatives | Emsland Group, InnovoPro |

| Insect Protein Ingredients | Novel protein sources from crickets and mealworms. | Cricket protein powder, insect flour | Sports nutrition, snacks, pet food | Aspire Food Group, Protix |

| Milk Protein Concentrate and Isolate | High-purity dairy proteins are used for fortification and functional foods. | MPC, MPI | Yogurt, cheese, sports nutrition, high-protein snacks | Fonterra, Idaho Milk Products |

| Hydrolyzed Plant Proteins | Enzymatically treated proteins for higher solubility and improved absorption. | Hydrolyzed pea protein, hydrolyzed soy protein | Infant nutrition, medical foods, beverages | Kerry, DSM Firmenich |

| Blended Protein Systems | Custom blends combining plant and animal proteins for improved amino acid balance. | Plant blend proteins, dairy plant blends | Sports nutrition, meal replacements | Glanbia Nutritionals, private label |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5929

Protein Ingredients Market Dynamics

What Are the Growth Drivers of the Protein Ingredients Market?

Higher demand for functional, plant-based, and convenient protein sources is a major factor driving market growth. Higher consumer awareness regarding health and nutrition, and the importance of protein for the body, is another major factor for the market’s growth. The growing population of vegans, vegetarians, and flexitarians, who demand plant-based protein sources, also helps fuel market growth. The availability of protein-rich food and beverage options in convenient forms, such as protein snacks, bars, and drinks, also helps drive market growth. Such options can be easily adopted by consumers to avoid unhealthy and unnecessary snacking, which is further helpful for market growth.

Challenge

Price Volatility Affecting the Market’s Growth

The raw ingredients required for the manufacturing of plant-based protein, such as soy, pea, and whey, may fluctuate for various reasons. Bad weather, geopolitical issues, or supply chain issues may affect the entire manufacturing process, resulting in higher costs. Hence, it also affects the final product's cost, thereby hampering the growth of the protein ingredients market.

Opportunity

Higher Demand in the Cosmetic Industry Is Helpful for the Market’s Growth

Higher use of plant-based ingredients such as pea, soy, wheat, rice, and almond helps to improve the skin texture, quality, and barrier repair. Hence, it helps to fuel the growth of the protein ingredients market. Such ingredients help to give a plump texture, enhance quality, and maintain the skin’s elasticity and youthfulness. Therefore, they are widely used in the cosmetic manufacturing industry, further fueling market growth. Such ingredients also help retain the skin’s moisture, further helping attract consumers’ attention and drive market growth.

Protein Ingredients Market Regional Analysis

North America Dominated the Protein Ingredients Market in 2024

North America led the protein ingredients market in 2024, driven by changing consumer lifestyles, rapid urbanization, and higher demand for convenient protein sources in the form of bars, snacks, and beverages. Such options allow consumers to avoid unhealthy snacking with ease and are available across various platforms, further fueling market growth. The US and Canada play a major role in the growth of the regional market due to high demand for convenient protein sources and growing consumer awareness of health and nutrition. The growing fad of high-protein diets such as keto and paleo in the US is another major factor fueling the market’s growth.

Asia Pacific Is Expected to Grow in the Forecast Period

Asia Pacific is expected to grow over the forecast period due to rapid urbanization, changing consumer preferences, and growing consumer awareness of health and nutrition, which are major factors driving the growth of the protein ingredients market. The growing population of vegans and vegetarians demanding plant-based protein options made from soy, wheat, soya, and fava also helps fuel market growth. Higher demand for convenient, ready-to-eat, and ready-to-cook options also helps to fuel the market’s growth in the foreseen period. Countries such as India, China, Japan, and South Korea have made major contributions to the growth of the region's market due to changing lifestyles, higher demand for convenient options, and greater demand for products with longer shelf lives.

Europe Has Observed a Notable Growth in the Foreseeable Period

Europe is expected to see notable growth over the forecast period due to changing consumer lifestyles, rising demand for convenient protein sources, and demand for healthier alternatives. The growing population of vegans, vegetarians, and flexitarians in the region is another major factor for the market’s growth. Higher demand for vegetarian, clean-label, and functional protein ingredients also helps fuel the growth of the protein ingredients market. Countries such as the UK, Germany, and France help fuel market growth through the growing organic industry, which supports the manufacturing of clean-label and plant-based protein sources.

Protein Ingredients Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 5.7% |

| Market Size in 2025 | USD 55.73 Billion |

| Market Size in 2026 | USD 58.90 Billion |

| Market Size by 2034 | USD 91.78 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Trade Analysis of Protein Ingredient Market

Import & Export Statistics

Global Trade Scale and Recent Trend Signals

The global protein ingredients market covers animal proteins (whey, casein, collagen), plant proteins (soy, pea, wheat, oat), and emerging precision fermentation and single-cell proteins used in food, beverages, nutrition, and feed. Market estimates for 2024 place the sector in the tens of billions of US dollars, with mid-single-digit to low-double-digit CAGRs across subsegments (plant proteins growing fastest). Drivers include the growing demand for high-protein foods, sports nutrition, and clinical nutrition, as well as the shift toward plant-based and hybrid protein formulations.

Leading Exporters (Value and Volume)

Export leadership varies by ingredient: Brazil and the United States dominate global soybean flows that underpin soy protein supply, while the European Union and the United States are the largest exporters of whey and whey concentrates. Canada historically led pea exports into China but recent seasons saw Russia scale rapidly as a major pea origin for China’s pea protein industry. These origin shifts matter because they change freight patterns, processing location decisions and price signals for downstream protein ingredient processors.

Major Importers and Demand Hubs

Import demand concentrates in large processing and consumption markets. China is a leading importer of whey and plant protein feedstocks for its fast-expanding ingredient and meat-alternatives industry, while the EU and the United States are major importers of specialty isolates and concentrates for food manufacturing. Japan, South Korea and parts of Southeast Asia also import significant volumes of high-specification dairy and plant protein ingredients for infant formula, sports nutrition and fortified food lines.

Protein Ingredients Market Segmental Analysis

Product Analysis

The animal/dairy protein ingredients segment dominated the protein ingredients market in 2024, driven by higher demand for protein sources derived from dairy or animal-based ingredients. The market is also observed to be growing due to technological advancements in animal feed, pharmaceuticals, the food and beverage industry, and other related sectors. The growing demand for sports nutrition beverages and other protein sources also helps fuel market growth. The benefits of protein for muscle recovery, muscle building, and weight management are major factors driving market growth.

The insect protein segment is expected to grow over the forecast period, as insects require less feed, water, and land, further leading to lower greenhouse gas emissions. Hence, they are an ideal source of eco-friendly protein options that will help fuel the market's growth in the foreseeable future. Such protein options are also enriched with vitamins, minerals, and amino acids, which are beneficial for market growth.

Application Analysis

The food and beverage segment dominated the protein ingredients market in 2024, driven by higher demand for functional, organic, and plant-based products. The availability of protein sources in convenient forms, such as protein bars, snacks, and beverages, also helps fuel the growth of the protein ingredients industry. Higher demand for high-protein ready-to-drink beverages, baked goods, and snacks also fuels market growth. The availability of products with longer shelf life and enhanced taste and texture is another major factor driving market growth.

The animal feed segment is expected to grow over the foreseeable period due to rising demand for animal-based protein. It also leads to higher demand for high-quality, effective animal feed, which helps enhance livestock nutrition. It is a cost-effective, sustainable, and healthy option, further fueling the market’s growth. Hence, the segment will make a major contribution to the market's growth in the foreseeable future.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Protein Ingredients Market

• DuPont – Develops a wide portfolio of plant-based and dairy protein ingredients used in nutrition, bakery, beverages, and meat alternatives. The company focuses on functional proteins that enhance texture, stability, and nutritional value.

• Rousselot – A global leader in gelatin and collagen peptides used in nutrition, pharmaceuticals, and functional foods. The company specializes in high-purity proteins that support health, joint care, and clean-label applications.

• ADM – Produces soy, wheat, pea, and specialty plant proteins for food, beverage, and sports nutrition categories. ADM combines large-scale processing with advanced formulation capabilities for global brands.

• Burcon – Specializes in next-generation plant proteins, including pea, canola, and hemp protein isolates. The company focuses on high-purity, allergen-friendly ingredients for dairy alternatives and functional foods.

• Tessenderlo Group – Offers specialty proteins, gelatin, and collagen ingredients used in food, pharma, and animal nutrition. The company is known for high-quality protein extraction and processing technologies.

• Kewpie Corporation – Provides egg-derived and plant-based protein ingredients used in processed foods, dressings, and nutrition products. The company focuses on functional proteins with emulsification and gelation properties.

• Roquette Freres – A major producer of pea, wheat, and potato proteins for plant-based foods, sports nutrition, and bakery applications. Roquette emphasizes sustainability and large-scale pea protein production.

• The Scoular Company – Supplies plant-based proteins and grain-derived ingredients to the food, pet, and nutrition markets. The company offers soy, pulse, and novel proteins through integrated supply chains.

• CHS, Inc. – Produces soy protein concentrates and isolates used in food processing, animal feed, and meat alternatives. CHS operates across the full agricultural value chain, ensuring consistent ingredient quality.

• Mead Johnson & Company, LLC – Specializes in pediatric and infant nutrition formulas containing high-quality milk-derived proteins. The company focuses on clinically supported protein blends for early-life nutrition.

• CropEnergies AG – Produces sustainable wheat proteins and fermentation co-products, including high-protein animal feed. The company’s protein ingredients support food, feed, and bio-based sectors.

• Fonterra Co-Operative Group – A leading global dairy cooperative providing whey proteins, caseinates, and milk protein concentrates. Fonterra focuses on high-functionality dairy proteins for nutrition and sports applications.

• Bunge Limited – Supplies soy and other plant proteins across food, beverage, and feed markets. The company leverages extensive crushing and processing assets to produce large-scale protein ingredients.

• Cargill, Incorporated – Offers soy, pea, and specialty protein ingredients used in beverages, bakery, and plant-based meats. Cargill provides integrated supply, formulation, and clean-label solutions.

• MGP – Produces wheat and pea proteins, starches, and specialty ingredients for food, beverage, and nutrition applications. The company specializes in functional proteins with strong texturizing properties.

• Ingredion – Supplies pulse, rice, and pea protein ingredients designed for plant-based foods and nutrition products. Ingredion prioritizes clean-label, gluten-free, and sustainable protein solutions.

• Kerry Inc. – Provides dairy and plant protein ingredients used in beverages, sports nutrition, and functional foods. Kerry integrates flavor systems with proteins to improve taste and performance.

• Givaudan – Develops plant-based protein solutions paired with flavor masking and texture enhancement technologies. The company focuses on improving sensory profiles in meat and dairy alternative products.

• Axiom Foods – A leader in rice, pea, and hemp protein concentrates and isolates for clean-label nutrition. The company emphasizes allergen-free, non-GMO, and sustainable protein ingredients.

• Tate & Lyle – Produces plant-based protein ingredients and functional fibers for food and beverage formulations. The company integrates proteins with sweeteners and texturizers for balanced performance.

• Puris – A major supplier of non-GMO pea protein used in plant-based meats, dairy alternatives, and beverages. Puris operates vertically integrated pea supply chains with a strong sustainability focus.

• DSM – Provides dairy, plant, and microbial proteins for specialized nutrition, including sports and early-life applications. DSM focuses on science-driven protein innovation and nutritional fortification.

• Glanbia Plc – Produces high-performance whey and functional dairy proteins widely used in sports nutrition and clinical nutrition. The company also develops plant protein blends for emerging categories.

• Louis Dreyfus Company – Offers soy and specialty plant proteins supported by global processing and trading capabilities. The company supplies ingredients for food, feed, and plant-based product sectors.

• Barentz – A global distributor of specialty proteins and nutritional ingredients used in functional foods and beverages. Barentz partners with protein manufacturers to serve multiple regions and applications.

• Nutri-Pea – Specializes in Canadian-grown pea protein concentrates and isolates used in plant-based foods and beverages. The company focuses on high-purity, allergen-friendly protein ingredients.

• Prinova Group LLC – Provides protein ingredients, amino acids, and custom nutrient premixes for food, beverage, and sports nutrition. Prinova offers formulation support and global ingredient sourcing.

Segments Covered in the Report

By Product

- Plant Protein

- Cereals

- Wheat

- Wheat Protein Concentrates

- Wheat Protein Isolates

- Textured Wheat Protein

- Hydrolyzed Wheat Protein

- HMEC/HMMA Wheat Protein

- Rice

- Rice Protein Isolates

- Rice Protein Concentrates

- Hydrolyzed Rice Protein

- Others

- Oats

- Oat Protein Concentrates

- Oat Protein Isolates

- Hydrolyzed Oat Protein

- Others

- Legumes

- Soy

- Soy Protein Concentrates

- Soy Protein Isolates

- Textured Soy Protein

- Hydrolyzed Soy Protein

- HMEC/HMMA Soy Protein

- Pea

- Soy Protein Concentrates

- Soy Protein Isolates

- Textured Soy Protein

- Hydrolyzed Soy Protein

- HMEC/HMMA Soy Protein

- Soy

- Lupine

- Chickpea

- Others

- Roots

- Potato

- Potato Protein Concentrate

- Potato Protein Isolate

- Maca

- Others

- Potato

- Ancient Grains

- Hemp

- Quinoa

- Sorghum

- Amaranth

- Chia

- Others

- Nuts & Seeds

- Canola

- Almond

- Flaxseeds

- Others

- Animal/Dairy Protein

- Egg Protein

- Milk Protein Concentrates/Isolates

- Whey Protein Concentrates

- Whey Protein Hydrolysates

- Whey Protein Isolates

- Gelatin

- Casein/Caseinates

- Collagen Peptides

- Microbe-based Protein

- Algae

- Bacteria

- Yeast

- Fungi

- Insect Protein

- Coleoptera

- Lepidoptera

- Hymnoptera

- Orthoptera

- Hemiptera

- Diptera

- Others

- Roots

By Application

- Food & Beverages

- Bakery & Confectionary

- Beverages (Non-Dairy Alternatives)

- Breakfast Cereals

- Dairy Alternatives

- Beverages

- Cheese

- Snacks

- Others

- Dietary Supplements/Weight Management

- Meat Alternatives & Extenders

- Poultry

- Beef

- Pork

- Others

- Snacks (Non-Dairy Alternatives)

- Sports Nutrition

- Others

- Infant Formulations

- Clinical Nutrients

- Animal Feed

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5929

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.